Understanding the Process Behind an Online Tax Return in Australia and How It Works

Understanding the Process Behind an Online Tax Return in Australia and How It Works

Blog Article

Navigate Your Online Tax Obligation Return in Australia: Crucial Resources and Tips

Browsing the on-line income tax return procedure in Australia needs a clear understanding of your commitments and the sources readily available to streamline the experience. Crucial papers, such as your Tax File Number and income statements, should be meticulously prepared. Picking a suitable online system can significantly influence the performance of your declaring process. As you take into consideration these variables, it is critical to likewise be aware of usual pitfalls that many encounter. Recognizing these nuances can eventually conserve you time and lower stress and anxiety-- bring about a much more beneficial result. What strategies can best assist in this undertaking?

Recognizing Tax Obligation Responsibilities

Recognizing tax commitments is essential for individuals and businesses running in Australia. The Australian tax system is governed by numerous laws and guidelines that call for taxpayers to be aware of their obligations. Individuals must report their earnings properly, that includes salaries, rental revenue, and investment profits, and pay tax obligations as necessary. In addition, locals should recognize the difference between taxed and non-taxable revenue to make sure compliance and optimize tax end results.

For companies, tax commitments encompass numerous facets, including the Goods and Provider Tax Obligation (GST), company tax, and payroll tax obligation. It is important for services to sign up for an Australian Organization Number (ABN) and, if relevant, GST enrollment. These duties demand meticulous record-keeping and timely entries of income tax return.

Additionally, taxpayers ought to be acquainted with readily available deductions and offsets that can alleviate their tax obligation problem. Consulting from tax professionals can provide useful insights into optimizing tax obligation settings while guaranteeing compliance with the law. On the whole, a detailed understanding of tax obligation obligations is essential for effective monetary planning and to prevent charges related to non-compliance in Australia.

Vital Documents to Prepare

Furthermore, assemble any kind of appropriate bank statements that show passion income, in addition to reward declarations if you hold shares. If you have various other incomes, such as rental properties or freelance work, guarantee you have documents of these incomes and any kind of associated expenses.

Consider any type of personal health insurance declarations, as these can influence your tax obligations. By gathering these crucial papers in advance, you will enhance your on the internet tax return procedure, decrease errors, and maximize prospective refunds.

Picking the Right Online System

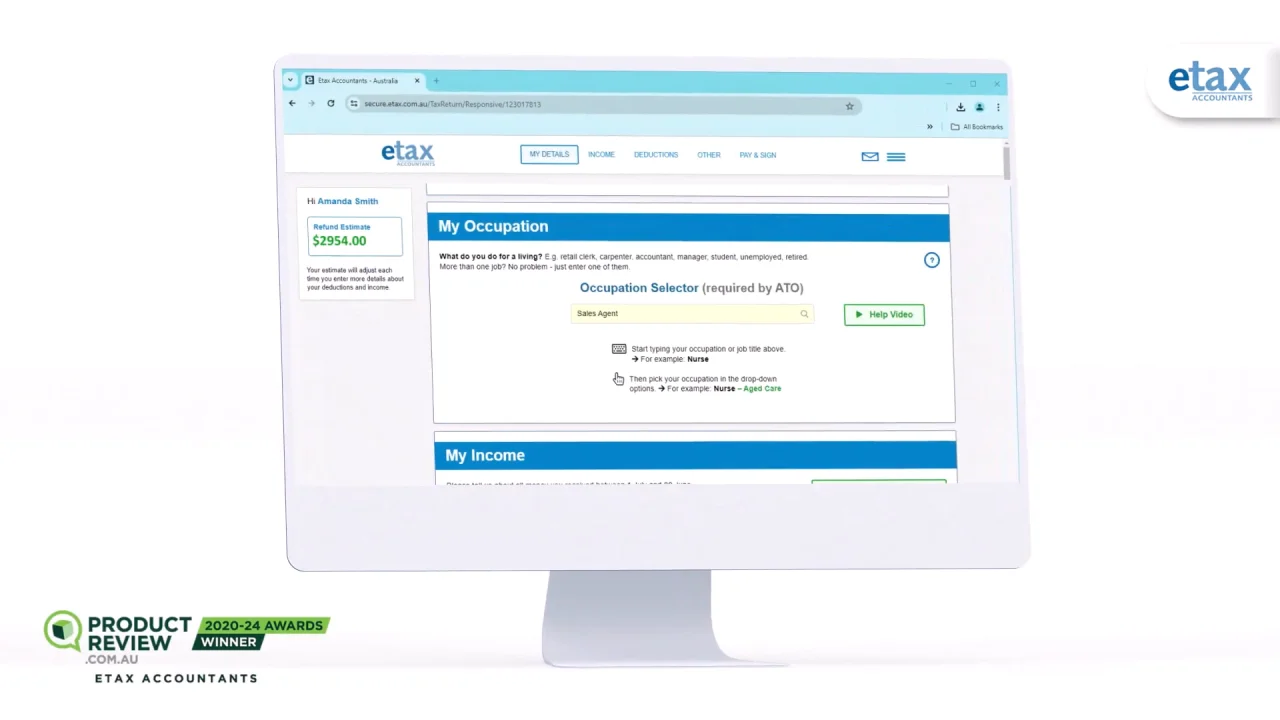

As you prepare to file your on the internet tax return in Australia, selecting the appropriate platform is essential to guarantee precision and ease of usage. A simple, intuitive design can considerably enhance your experience, making it less complicated to browse intricate tax forms.

Next, assess the platform's compatibility with your financial situation. Some services provide particularly to individuals with simple tax returns, while others provide thorough support for much more intricate scenarios, such as self-employment or investment income. Look for systems that offer real-time error checking and advice, helping to lessen mistakes and making sure conformity with Australian tax obligation laws.

Another important aspect to consider is the degree of customer support offered. Dependable systems ought to give access to help through phone, e-mail, or conversation, particularly throughout optimal filing durations. Furthermore, research customer evaluations and rankings to gauge the general contentment and integrity of the system.

Tips for a Smooth Filing Process

If you follow a few crucial ideas to guarantee efficiency and precision,Filing your online tax obligation return can be a simple procedure - online tax return in Australia. Collect all required Click Here papers before starting. This includes your income statements, invoices for reductions, and any type of various other relevant documents. Having everything available reduces errors and disturbances.

Next, make the most of the pre-filling function offered by numerous on-line platforms. This can conserve time and lower the possibility of blunders by automatically inhabiting your return with details from previous years and data supplied by your employer and monetary organizations.

In addition, verify all entrances for accuracy. online tax return in Australia. Blunders can cause postponed refunds or problems with the Australian Taxation Office (ATO) Make certain that your personal information, earnings figures, and deductions are proper

Bear in mind deadlines. If you owe taxes, declaring early not only reduces stress but additionally allows for far better planning. If you have inquiries or unpredictabilities, get in touch with the help areas of your chosen system or look for expert guidance. By complying with these ideas, you can browse the on-line income tax return procedure efficiently and with confidence.

Resources for Help and Support

Browsing the intricacies of on other the internet income tax return can occasionally be complicated, yet a variety of sources for help and assistance are readily offered to aid taxpayers. The Australian Taxation Workplace (ATO) is the primary resource of info, supplying thorough overviews on its site, consisting of Frequently asked questions, educational videos, and live conversation choices for real-time assistance.

Additionally, the ATO's phone support line is readily available for those that like straight interaction. online tax return in Australia. Tax obligation professionals, such as licensed tax representatives, can likewise provide personalized support and ensure conformity with current tax policies

Verdict

Finally, efficiently browsing the on-line income tax return procedure in Australia requires a detailed understanding of tax commitments, meticulous preparation of crucial files, and cautious selection of an appropriate online platform. Abiding by useful tips can enhance the filing experience, while readily available resources use useful support. By coming close to the process with persistance and attention to detail, taxpayers can guarantee compliance and make the most of possible benefits, ultimately adding to a much more reliable and successful tax return outcome.

As you prepare to submit your online tax return in Australia, picking the appropriate platform is important to guarantee precision and simplicity of use.In conclusion, efficiently browsing the on the internet tax obligation return procedure in Australia requires a comprehensive understanding read here of tax commitments, thorough preparation of important files, and careful selection of an ideal online platform.

Report this page